Selling a house “as-is” in Florida means you’re listing the property in its current condition. You’re not responsible for making repairs or upgrades, even if the buyer finds issues during an inspection. But under Florida law, you are still required to disclose any known material defects that could affect the property’s value, safety or desirability.

This is very different from a standard real estate transaction, where a buyer can submit a notice of repairs after the inspection, and the seller may be obligated to address certain items under the contract or negotiate credits or price reductions.

To legally sell your house as-is in Florida, here’s what you need to know:

- You must disclose any known defects, like roof leaks, mold or foundation problems.

- Buyers have the right to inspect the property but can’t demand repairs.

- Most as-is transactions use the FAR/BAR “As Is” contract, which outlines the buyer’s inspection rights, seller duties and as-is sale terms.

- You’re still responsible for maintaining the property’s condition through closing.

You might be considering an as-is sale for a variety of reasons. Maybe you don’t have the time or money to make repairs, you inherited a home or you need to sell quickly.

No matter your situation, we’re here to help you make the best decision. If you’re looking to sell your house fast in Florida, working with a local cash buyer like us can make the process simple and stress-free.

Table of Contents

- How to Sell Your Home As-Is in Florida

- The Buyer’s and Seller’s Roles in the As-Is Sale Process

- Can You Sell a House As-Is Without the Buyer Inspecting It?

- Can Buyers Back Out of an As-Is Contract?

- What Do You Have to Disclose When Selling As-Is?

- What Don’t You Have to Disclose When Selling As-Is?

- Should You Sell Your Florida Home As-Is?

- When Should You Fix Up Your Home Instead of Selling As-Is?

- How Much Will We Offer You for Selling Your Home As-Is?

How to Sell Your Home As-Is in Florida

If you’ve decided you want to sell your home as-is, you have multiple routes to choose from. The exact process will depend on how you choose to sell, but these sections detail the basic steps to get you started.

1. Get a Pre-Listing Inspection

While not required, getting an upfront pre-listing inspection done will help you prepare for potential buyers. It typically costs $200 to $400 depending on your location and the size of the property, but it can help you anticipate issues that buyers (or their inspectors) will likely uncover later. It allows you to price the property more accurately, avoid surprises and offer transparency that builds buyer confidence.

Some sellers even get contractor estimates for common repairs to help buyers budget. This can be especially appealing to real estate investors or first-time buyers looking for a fixer-upper.

2. Determine How You’d Like to Sell Your House

You could go the traditional route and list with a realtor, sell to a cash home buyer like Florida Cash Home Buyers or choose another avenue. Any home selling method comes with its pros and cons, so be sure to weigh the following options to determine which is best for your needs:

- Cash home buyer: If you need to close the deal fast, working with a cash buyer might be the way to go. However, you might get a lower price for your home than you would otherwise because investors buy to make a profit.

- Real estate agent: Working with a real estate agent means having a professional on your side to handle the complexities of the sale, like navigating real estate contracts and setting your list price and using their network and expertise to market your property. But it also means paying commission fees, which might be as high as 5% to 6% of the sale price.

- For sale by owner (FSBO): Selling the property on your own can help you save big on costs like real estate agent commission fees, but it requires expertise in the Florida real estate market and makes the process much more time-consuming for you. If you aren’t familiar with the housing market, it may not be the best option.

3. Gather Documents and Fill Out Seller Disclosures

Paperwork is a big part of home sales, and it’s very important to ensure you have all the details lined up. The documents you need will both prove your right and ability to sell the house, as well as identify the property to be sold and the rights associated with it. These include:

- Proof of identity

- Deed

- Original Purchase and Sale Agreement

- Mortgage statement

- Property and maintenance history

- Preliminary home title search

You’ll also need to fill out a seller disclosure form covering the defects we outline below, like material damage and environmental hazards. If you’re working with a professional, they can help you fill out forms, gather documents and make sure everything is in order.

4. Price and List the Property

Use the pre-inspection report and local market data to set a realistic price. You can also hire a real estate appraiser to get a third-party opinion (usually costs around $300 to $500) who can offer an unbiased value estimate. It’s also helpful to assess the home’s value both as-is and fully repaired, so buyers can understand its potential.

Real estate listing agents may provide a comparative market analysis (CMA) for free. But remember, they may inflate the price to win your listing.

If you’re selling to a cash home buyer like Florida Cash Home Buyers, you can skip this step. We’ll come up with a fair offer. All you have to do is call us or submit a request online.

5. Close the Sale and Transfer Ownership

Once you’ve accepted an offer, the final step is the closing process. This includes signing the necessary documents, transferring the deed and receiving your payment. If you’re selling through a traditional route, this process can take 30 to 60 days, especially if the buyer is financing the purchase.

But if you work with a cash home buyer, you can often close more quickly. At Florida Cash Home Buyers, we’ve closed in as little as five days. We handle the paperwork, cover the closing costs and make the process as easy as possible so you can move on quickly and with peace of mind.

The Buyer’s and Seller’s Roles in the As-Is Sale Process

As-is home sales in Florida typically use the FAR/BAR “As Is” Residential Contract for Sale and Purchase. Unlike the standard residential contract, which may require the seller to make repairs up to a specified dollar amount, the as-is version allows the property to be sold exactly as it stands without repair obligations.

That doesn’t mean, however, that the seller doesn’t have responsibilities or that the buyer doesn’t get to do their due diligence.

If you’re considering an as-is sale, it’s important to understand the rights and responsibilities of buyers and sellers. Here’s a brief overview of the as-is sales process:

- Sellers must disclose any known material defects that significantly affect the property’s value and wouldn’t be obvious to the buyer, such as a cracked foundation, electrical problems or termite infestation.

- Buyers have a 15-day inspection period (unless otherwise noted or waived) to assess the condition of the home. If they’re not satisfied, they can cancel the contract and receive their deposit back.

- If the buyer requests a price reduction or other changes after the inspection, the seller has the right to say no. At that point, the buyer can either close at the original terms or walk away. If the buyer agrees to move forward but fails to close, the seller may keep the deposit as liquidated damages.

- The buyer is responsible for any repairs and improvements after the inspection period is over and they have agreed to purchase the property.

- Sellers may still be liable after closing. In Florida, the statute of limitations for failure to disclose known defects is up to four years, or five years for written contract claims. Providing full, written disclosures can help protect you from legal action later.

Understanding these roles upfront helps ensure a smoother, legally compliant transaction and helps both parties avoid surprises later.

Can You Sell a House As-Is Without the Buyer Inspecting It?

Technically yes, but only if the buyer waives their inspection rights. Under Paragraph 12 of the standard as-is contract, buyers are typically given a 15-day inspection period unless otherwise shortened, extended or waived. Some buyers, such as those planning to demolish the home, may choose to skip the home inspection altogether. However, most buyers still use this period to uncover major issues before fully committing to the sale.

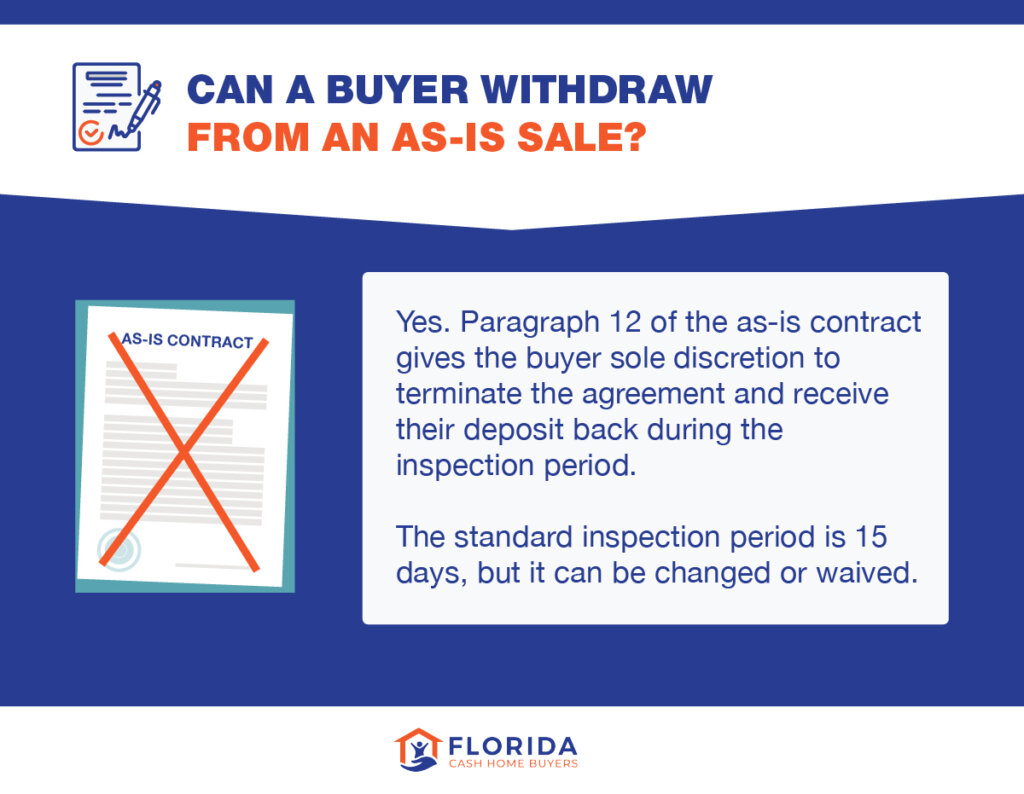

Can Buyers Back Out of an As-Is Contract?

Yes, buyers may back out of an as-is contract during the inspection period for any reason. Paragraph 12 of the contract stipulates that the option to terminate resides in the buyer’s “sole discretion.”

If the buyer independently decides that the property doesn’t meet their expectations or requirements, they can cancel the contract. Cancellations have to be communicated to the seller through written notice before the inspection period ends. As long as the buyer does this, their deposit gets reimbursed, and the buyer and seller will be released from their obligations.

If the inspection period is over, it’s more difficult for the buyer to back out of the contract. If they still choose to back out, they may face fees and penalties.

What Do You Have to Disclose When Selling As-Is?

Florida is a “duty to disclose” state. This means the home seller has to inform the buyer of any defect on the property that could put occupants in danger, like health hazards from mold or asbestos, or that could materially change the property’s value, like the presence of a dumpsite in the neighborhood.

Florida provides a set of disclosure forms every homeowner must complete honestly. You aren’t allowed to misrepresent the condition of the property by disguising damages either. If the buyers find out that you’ve been dishonest at any point in the process, they’re entitled to sue even after taking possession of the building.

These rules are backed by Paragraph 10 of the as-is contract and the Johnson vs. Davis case, which established that sellers have a legal duty to disclose material facts that are not readily observable and are not known to the buyer.

That said, if you genuinely don’t know about a problem (especially if you’ve never lived in the home) you generally aren’t liable. But if a buyer can prove you knew and concealed an issue, they may sue you even after the closing date. Florida’s statute of limitations allows buyers to file claims for up to four years — or up to five years when a written contract is involved. Full, written disclosures are your best defense.

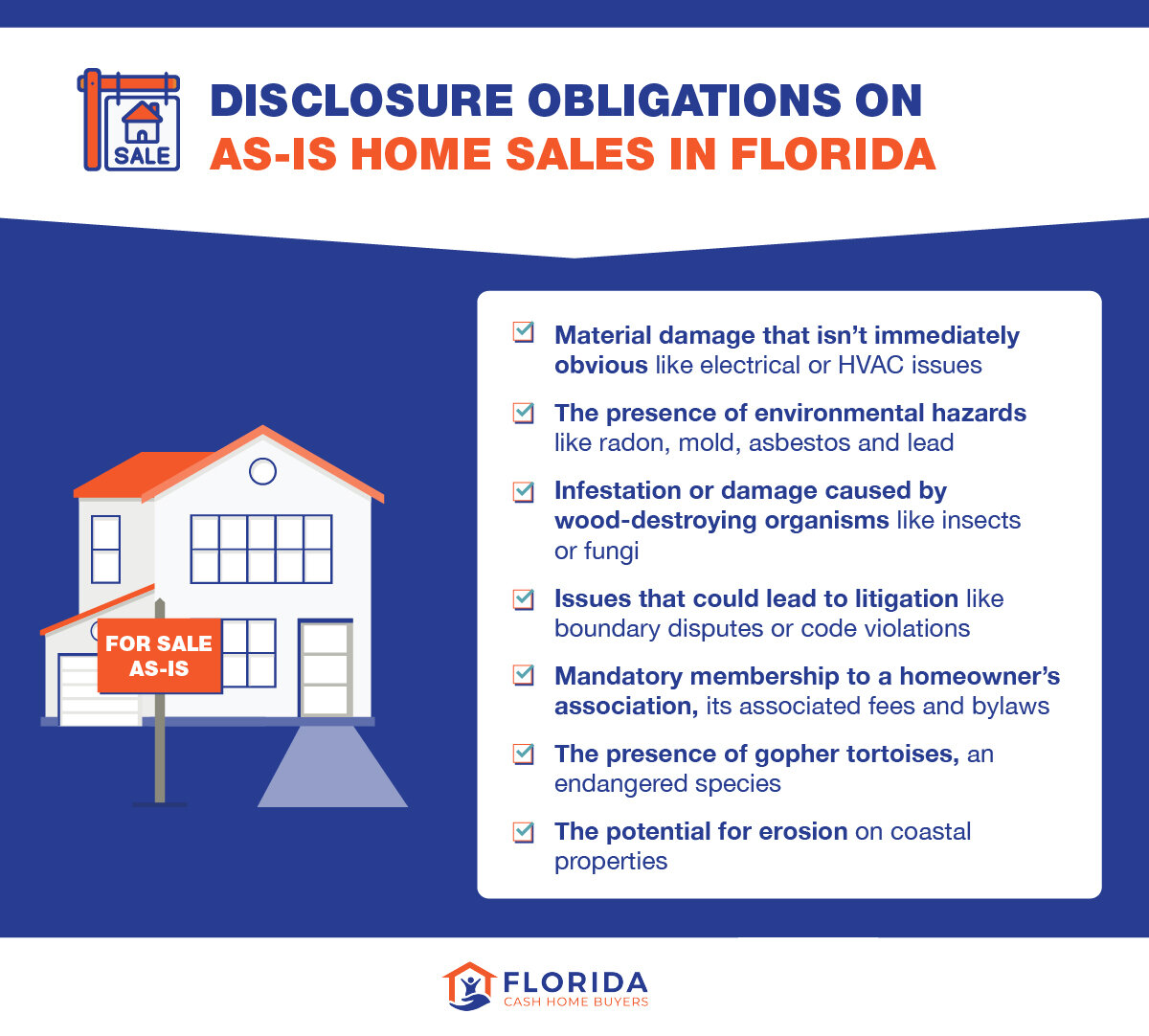

In addition to the examples above,this general overview explains what sellers have to disclose:

Any material damage in the property or any essential components (electric system, plumbing, HVAC, etc.) that may not be immediately obvious to the buyer or home inspector. For example, a crack in the foundation that leaks in case of heavy rain.

The presence of environmental hazards on the property that could affect the occupants’ physical, mental, and social well-being, such as mold, asbestos, radon and lead (for houses built before 1978).

Any infestation or damage caused by wood-destroying organisms such as insects (including termites and ants) or fungi.

Any issues that could lead to litigation, such as any dispute about property boundaries, code enforcement violations (an illegal addition, for example) or problems with the property title.

Any mandatory membership to a condominium or homeowner’s association. The property seller must disclose the bylaws, fees and restrictions. Failure to do so could lead to the sale being voided.

If gopher tortoises – an endangered species – are nesting on the property. According to state law, it is illegal to harm, capture or transport gopher tortoises or damage their burrows, except as authorized by specific Florida Fish and Wildlife Conservation Commission (FWC) permit.

Coastal property owners must inform buyers of the potential for erosion and whether or not the property might be subject to regulations regarding construction, rigid coastal protection structures and beach nourishment. The presence of sinkholes, past or current, must also be disclosed.

Florida sellers can easily find disclosure forms online. Sellers have no legal obligations for them to use the official Florida Association of Realtors form. In fact, disclosing any issues verbally to the sellers discharges you of your legal obligations. However, in case of any problems down the road, it’s best to get everything clearly in writing. Being proactive will protect you in case of litigation.

What Don’t You Have to Disclose When Selling As-Is?

Though many issues must be disclosed, you’re not obligated to tell buyers everything about your home’s history. Certain things aren’t covered by disclosure laws, including:

- Cosmetic issues, such as peeling wallpaper or damaged drywall, that are readily observable by the buyer.

- A death, suicide, or homicide that occurred on the property.

- Your home’s flood history. It’s considered the buyers’ responsibility to do their due diligence.

Should You Sell Your Florida Home As-Is?

Like any property-moving strategy, you face pros and cons to selling as-is. If you need to sell quickly, need cash fast or don’t have the time and money for costly repairs, it may be a good option. But if the property is in good shape, selling as-is may not be the best option for you.

| Pros | Cons |

|---|---|

| You don’t have to spend money & time on making repairs. | The pool of potential buyers is smaller if the property is in bad shape. |

| You can sell the home quickly and save money on holding costs such as a mortgage, insurance, taxes, HOA, etc. | You will most likely end up selling to an investor who typically pays less than a retail buyer. |

| A quick sale gives you faster access to cash than a standard sale which may have a longer closing time. | Selling “as is” may have a bad reputation. Some buyers may think you are trying to hide issues with the property. |

| You don’t have to deal with the headache of managing contractors and handymen. | Buyers have a strong right of cancellation and can walk away with their deposit during the inspection period. |

| Investors love buying properties “as is” so that they can fix them up and resell for a profit. | If there aren’t many investors in your area, the house may take a long time to sell. |

Pros of Selling As-Is

- Avoid repair negotiations after the home is inspected. Selling as-is means that you’re not responsible for the repair costs. The buyer is responsible for any repairs that need to be made.

- Close on the property quickly. Repairing damages often takes time and money. During this time, you may be paying holding costs like mortgage, insurance, tax and HOA fees. When you sell as-is, it’s usually easy to find investors that will fix up the property themselves and resell it. This avoids the stress and hassle of making intensive repairs.

- Access cash fast. By selling your house as-is in Florida, you can close quickly and use the proceeds to purchase another property, pay off your debts or settle any litigations such as a divorce or an inheritance.

- Don’t need to acquire funding for home improvements. Proceeding to make necessary repairs or cosmetic improvements can be extremely expensive, especially if the house suffers from considerable damages such as water or fire or if maintenance has been deferred for some time. It can be difficult to afford these repairs, and funding them through loans means that you’ll need to pay interest and fees.

- Avoid issues with the buyer’s financing falling through. Properties listed as-is typically appeal primarily to cash buyers and investors. Regular home hunters usually need to obtain a mortgage and must often deal with financing-related delays. In some cases, the deal may fall through at the last minute if there are any issues during the loan process.

Cons of Selling As-Is

- You have a smaller pool of potential buyers. Typical home buyers may not have financing options as lenders typically don’t finance properties in poor condition. The vast majority of interested parties will be cash buyers and real estate investors.

- The house will sell below market value. An as-is listing may need to be priced below market value to appeal to buyers and compete with similar properties because likely purchasers are interested in potential returns on investments. They will still need to add the costs of repairs to bring it up to livable condition to rent it or sell it for a profit.

- Selling as-is has a bad reputation. Buyers may deem an as-is sale too risky, especially if the property appears in disrepair.

- Buyers can walk away during the inspection period. The buyers have a lot of power up until the end of the inspection period. If they walk away, you’ll need to start the process over again.

- The house may be on the market for a long time. While investors and cash buyers like us are happy to buy as-is properties, some markets aren’t investor-friendly or the condition of properties may not yield a favorable return.

When Should You Fix Up Your Home Instead of Selling As-Is?

Selling as-is is great if you want to sell your house fast or the property needs extreme repairs. However, for certain scenarios, it might make sense to fix up your home so that it’s closer to move-in ready.

If the repairs are minimal and cosmetic for the most part, it may be in your best interest to improve your property’s condition before putting it on the market. You’ll attract a bigger pool of prospective buyers, and you can probably recoup the cost of your investment by setting a higher price in the sale of the house, especially if you’re willing to do some or most of the repairs yourself.

And if you don’t want to fix the house before listing it, you can cut down your asking price or offer concessions to potential buyers to go toward resolving some of the most prominent issues, such as changing damaged carpets.

How Much Will We Offer You for Selling Your Home As-Is?

At Florida Cash Home Buyers, we’ll make you a fair cash offer with no obligation to accept. We calculate our offer by subtracting the cost of renovations, our holding and selling costs, and our minimum required profit from the After Repair Value (ARV) of the property. Holding and selling costs are about 10% and our minimum required profit is 10%.

Say the ARV of your property is $300,000 and repairs will cost us $40,000. We’d calculate our offer like this: ($300,000 x 80%) – $40,000 = $200,000 cash offer.

Get a Quote for Your Florida Home Today!

Experienced cash buyers like us are equipped to buy property a lot faster than the typical selling process. It could be months between the moment you list your house as-is and when you finally hand over the keys, especially if your property isn’t in the best shape.

Skip the potential risks of unqualified buyers, lowball offers or deals that fall through. We’ll offer you a fair price for your fixer-upper and can close in as little as a few weeks. Contact us today for a quote.