How to Sell a House Without a Realtor in Florida (FSBO)

Selling your home through a realtor has its perks, but it comes with hefty listing agent commissions and fees in addition to the buyer’s agent commissions. When you sell by yourself — known as for sale by owner (FSBO) — you can avoid some of these costs and gain more control over the sale. However, going the FSBO route comes with challenges that aren’t worth it for most people, unless they have real estate knowledge or have a buyer lined up.

The National Association of Realtors (NAR) reports that FSBO homes typically sell for 30% less than homes sold with the help of an agent. Another survey showed that over a third of people made legal mistakes during their FSBO process.

If you want to avoid the costs of a realtor and don’t want to deal with the stress of FSBO, there are other options to sell quickly, including selling to a cash-home buying company like Florida Cash Home Buyers.

This post explains exactly how to sell your home by yourself in Florida along with the pros and cons of FSBO, so you can make the right decision for your situation and see what route saves you the most money.

Table of Contents

- How to Sell a House by Owner in Florida (8 Steps)

- Paperwork for Selling a House without a Realtor in Florida

- Pros and Cons of Selling a House by Owner in Florida

- Will I Save Money Selling My Florida Home Without a Realtor?

- What Taxes Will I Have to Pay?

- Is FSBO Right for Me?

- Alternatives to Selling Your Home by Yourself

How to Sell a House by Owner in Florida (8 Steps)

The FSBO sale route sounds intimidating, and it generally involves a lot of work. From decluttering and adding curb appeal to assessing market value and deciding whether you want to deal with open houses, you have a lot to consider throughout the selling process. To help you get started, we’ve broken the process down into eight key steps.

In addition to preparing and marketing the house, you’ll need to complete a lot of paperwork. Skip ahead to see the full list of documents you’ll need.

1. Hire a Title Company

You might think it’s possible to handle every aspect of the sale alone, but, even if you’re selling your Florida house FSBO, it’s still advisable to hire professionals to deal with some of the more complex parts of the process.

For example, a title company will perform a title search and make sure the title is clear, provide title insurance that is typically required by lenders, and assist with escrow. Title companies can also hold earnest money until the sale closes.

2. Conduct a Pre-Listing Inspection

Florida has seller disclosure laws, meaning you have to disclose any defects in the house to potential buyers before the sale. Getting a pre-listing inspection can help you complete this part of the paperwork accurately, and avoid issues or disputes later in the process.

You’ll need to pay for a home inspection, which can cost $200 to $400 depending on the size of the property. It can also give you a sense of the cost of any repairs needed, which can help with negotiations later.

If you decide to sell to a cash homebuyer, you can forego the pre-listing inspection.

What Do You Have To Lose? Get Started Now…

3. Choose a Competitive Price

Decide how much you want to sell your home for, paying attention to factors like the current real estate market, a reasonable assessment of your home’s value, and the property’s condition. If you price too low, you stand to lose money, but pricing too high in an effort to get top dollar means you’re less likely to get buyers.

As part of their full service, real estate agents or realty companies generally will perform a competitive market analysis to help determine your listing price. But you can do this on your own too, by researching similar properties in the area (called comps) as well as recent sales.

Getting a professional valuation might give you the most accurate price. Here are your options:

- Broker price opinion (BPO): A professional estimation of a property’s value by a real estate broker or agent. A BPO doesn’t require contact with the property owners, so they’re often used to determine the value of foreclosed homes. This is the quickest and cheapest option.

- Comparative market analysis (CMA): Similar to a BPO, a CMA is less comprehensive and puts more emphasis on the property’s relative value based on comparable homes in the area.

- Appraisal: The most thorough valuation, appraisals are conducted by a state-licensed and state-certified appraiser with no stake in the outcome of any deal. A bank may ask for this if the buyer is applying for financing.

4. Get Your Home Ready to Sell

Once you’ve assessed pricing, you need to make your home presentable for prospective buyers before you put it on the market. This involves:

- Cleaning and organizing the home to give buyers a good first impression.

- Completing minor repairs and getting estimates for larger repairs to factor into the value.

- Making small improvements like lighting or cosmetic touches that increase the home’s visual appeal.

- Finding appliance warranties, guarantees and user manuals for any major appliances in the home, like the dishwasher or washer/dryer.

- Staging your home to remove clutter and make your house look warm and inviting. You don’t need a professional stager to make this work — spend a few hours walking through the show homes in new construction neighborhoods, and you’ll get a great idea of what proper staging looks like.

Banks may require you to complete certain types of repairs before they approve loans. These include having functional carbon monoxide monitors and fire alarms and fixing things like structural issues in the foundations or roof or exposed wires.

If your house has significant issues or damage and you don’t want to make repairs, you may need to sell your property as-is. That means it’s sold in its current condition, and you have no obligation to complete repairs if the buyer finds issues. The buyer agrees to buy the property with all its flaws.

To sell as-is, you’ll need to create an as-is contract for the sale. Keep in mind that this will decrease your number of potential buyers, as most lenders require a property to meet certain livability standards for financing, and fewer buyers generally want to invest in a fixer-upper. However, cash home buyers like us will buy houses as-is.

What Do You Have To Lose? Get Started Now…

5. List Your Property and Promote the Sale

Once the property is ready, create an FSBO listing so potential buyers can find it. Here are some places you can list your property:

If you want your property to appear on real estate websites (like Realtor.com), you’ll need to add it to the Multiple Listing Service (MLS). This is only accessible to agents, so to list there, you’ll need to use a listing service company. These companies charge a fee ranging from around $100 to over $500 depending on whether other services are included or other fees charged.

Here are some other methods you can try to promote the sale:

- Using your network of friends, relatives or neighbors to spread the word about your house for sale

- Putting up a yard sign

- Creating and promoting your own website or using social media

To make your home look as appealing as possible, you may want to use professional photos for your listing. A professional photographer understands how to photograph your home and rooms with the right angles and lighting to showcase them in the most positive light.

6. Manage Showings

If you’re selling the home yourself, you’re responsible for arranging and managing showings. This can be difficult if you have children or pets and are still living in the property.

Alternatively, you could install a lockbox on your house and provide the code to buyers so they can view your home even when you’re not personally available.

You’ll also have to deal with emails, calls, and realistically, a lot of time wasters. To help with this, stay organized and be polite and responsive to buyers. If you take too long to answer potential buyers or don’t accommodate them, they’re likely to move on to another option. When you are showing the home to potential buyers, make sure to give them space to look around and talk amongst themselves.

7. Negotiate with Buyers

Once you start receiving interest in the property, you’ll have to negotiate with potential buyers (or the buyers’ agents) on the price. Be prepared for some of them to make low offers. Negotiating is an art in itself — the more knowledge you have about the local market and real estate in general, the stronger the position you’ll be in.

You may want (or need) to make concessions in order to close with a better price or get a quicker sale. For example, you might offer to pay some of all of the buyer’s closing costs, like:

- Inspection and appraisal fees

- Mortgage points (a.k.a. “discount points”)

- Settlement fees

- Title insurance

- Prepaid property taxes and homeowners insurance

You might also offer other concessions, including:

- Repairs or credits for repairs to address issues revealed during the inspection process

- A home warranty policy

- Covering other fees, like attorney fees to review the contract

When someone makes an offer, you usually have two to three days to respond. Keep in mind that the highest offer in price may not be the most lucrative for you if there are contingencies. For example, if the offer is contingent on financing, it could fall through, or if there are contingencies based on what is found during the property inspection.

8. Review Paperwork and Close the Sale

If you come to an agreement with the buyer on the terms of your real estate transaction, you can put together a purchase contract that both of you must sign. According to Florida law, there is no legal requirement to hire a real estate lawyer for closing in Florida. However, the paperwork involved is complex, so you may want to use an attorney to ensure all your bases are covered. For example, you’ll need to include a property disclosure.

To close the sale, sign all necessary documents, transfer the title, and handle the financial transactions. If you hired a title company initially, they’ll submit the paperwork and collect funds during closing.

What Do You Have To Lose? Get Started Now…

Paperwork for Selling a House Without a Realtor in Florida

To sell a house by yourself in Florida, you’ll need to complete a lot of complex paperwork with real legal implications if there are errors. Usually, this is handled by the realtor.

Here are the main documents you’ll need to provide in Florida:

- Property deed: Legally transfers the property. Describes the property and names both the seller and buyer.

- Purchase and sale agreement: Outlines the terms of the sale, including the price and relevant dates.

- Closing/settlement statement: Summarizes all expenses involved in the transaction and which are due at closing.

- Title reports: Contains an overview of the ownership history of the property as well as its legal status, including any liens on the property.

Since Florida is a “duty to disclose” state, you also have an obligation to disclose certain details about the property’s history and condition before completing the sale. Here’s what Florida law requires:

- Property disclosure: A disclosure form provides information about the property’s condition and history. You can download the form from the Northeast Florida Association of Realtors here.

- Lead-based paint disclosure: This disclosure is required for properties built before 1978. Download relevant forms here.

- Residential radon gas measurement report: Use this report to explain any dangers associated with radon gas, which often naturally occurs in buildings in Florida. Download the form here.

Depending on the property, you may also need to disclose if there is a flood risk, coastal regulations regarding construction and erosion, information about mandatory homeowners association membership, existence of any pending code enforcement actions and a property tax summary.

Other documents you may need to prepare include:

- Home inspection report

- Survey results showing property boundaries

- Plans and permits

- Mortgage documents

- Home warranty information

- Receipts for repairs

- Utility and property tax bills

- Homeowners association documents

- Floorplans and blueprints

- Details of easements and restrictions on the property

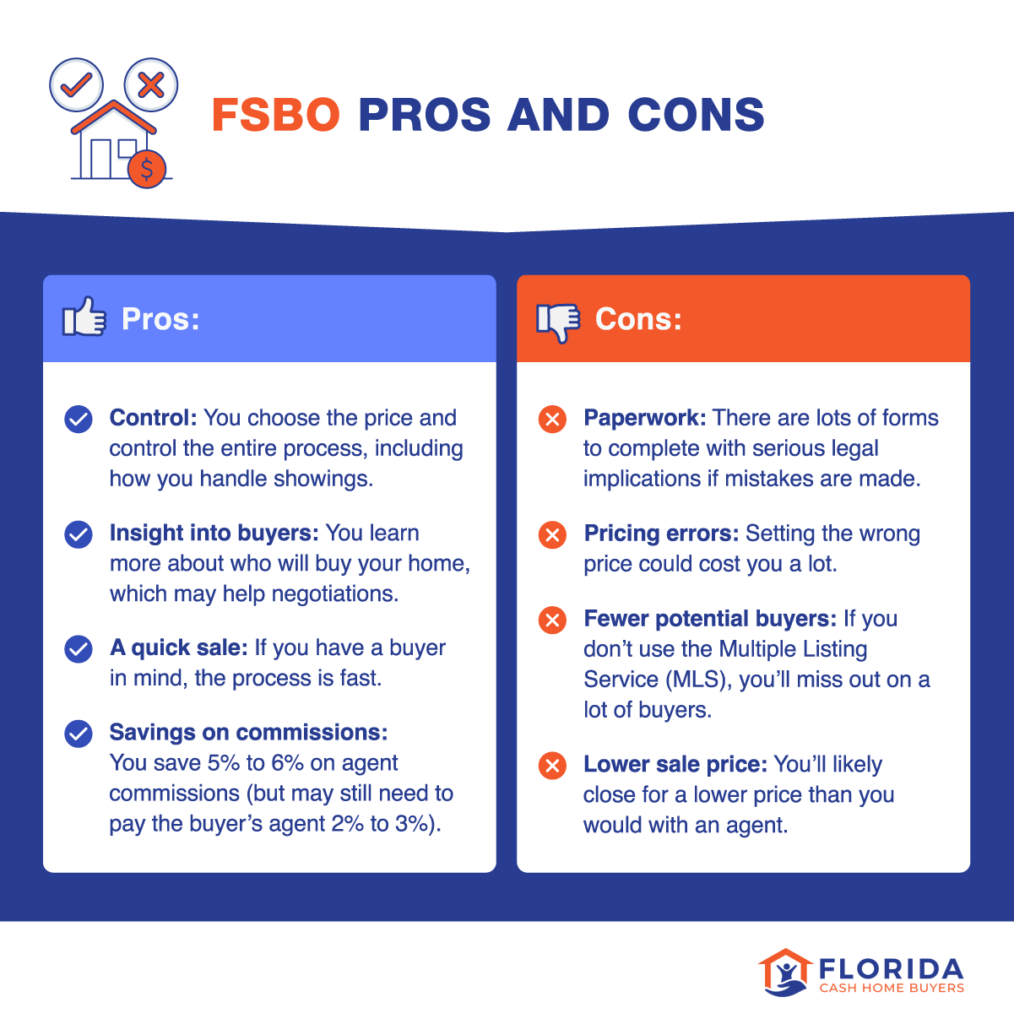

Pros and Cons of Selling a House by Owner in Florida

For the average home seller, the cons generally outweigh the pros. Still, there are advantages to going FSBO, especially if you have real estate knowledge and a buyer lined up.

Pros

Some of the main benefits of FSBO include:

- Control over the process: You set the price and have total control over marketing and showing the property.

- Insight into buyers: Handling all interactions yourself means you’ll gain greater insight into who will buy your home, which may help negotiations.

- Quicker sales: FSBO may be quicker than selling through an agent. But keep in mind that any statistics you see about this are influenced by the fact that the seller may already know the buyer.

- Savings on commissions: Selling on your own means saving on real estate commission fees, which typically range from 5% to 6% of the sale price. However, if the buyer uses an agent, they may only be interested in showing homes where they’ll receive a typical 2% to 3% commission, meaning you’re only saving 2% to 3% by going the FSBO route.

Cons

Here are some of the most common challenges involved in the FSBO process:

- The paperwork: Selling on your own means you’re doing the jobs of both licensed real estate and legal professionals. That means handling considerable paperwork that has real legal implications if done incorrectly.

- Setting the price: In order to set the best price for your property, you’ll need to do extensive research into the market or hire a professional. Setting the wrong price could cost you a huge amount of money or delay the sale.

- Finding buyers: If you don’t list the property on the Multiple Listing Service (MLS), you miss out on a large segment of buyers (and realtors representing buyers). It’s difficult to do all the marketing yourself.

- Lower sale price: Even if you save on fees, you’ll likely still close for a lower price than you would with an agent.

Will I Save Money Selling My Florida Home Without a Realtor?

Yes, you will typically save at least 2% to 3% of the sale price on commission fees. However, there are other tradeoffs.

FSBO sellers typically sell their homes for less than the price of other homes. According to statistics from the National Association of Realtors (NAR) in 2023, agents sold homes for the median price of $405,00, but FSBO homes sold at a significantly lower median price of $310,000. So the 2% to 3% you’re “saving” on fees might actually translate to far less money overall if working with a realtor would net you a higher sale price.

In fact, the NAR says that homeowners who sold without a real estate agent are three times more likely to say they lost money on their home sale.

Here are some other costs you may need to consider when selling your home yourself:

- Professional cleaning fees

- Professional photography fees

- Virtual staging fees

- MLS listing fees

- Miscellaneous repair costs

- Real estate attorney fees

- Home appraisal fees

- Buyer’s agent fee

What Do You Have To Lose? Get Started Now…

What Taxes Will I Have to Pay?

Every situation is unique, so it’s best to consult with a tax professional for advice.

In general, there are three types of taxes you may have to pay:

- Property taxes: Set by the municipality of your property, these are usually prorated up to the closing date. You may be eligible for some tax credit.

- Capital gain taxes: The amount of capital gains tax you will have to pay on the sale of your house varies widely based on your situation, where you live, your income bracket, how long you have owned the property, if you used the house as your primary residence and other factors. For U.S. residents who have held the property for at least a year, the capital gain rates are typically equivalent to 15% to 20% of the profits. If you have used the property as your primary residence for at least two years in the past five years, you may qualify for an exemption — up to $250,000 for an individual or $500,000 for a married couple. You may also be able to write off a portion of the profits from your income tax if you were forced into selling your house due to hardship, such as a health event or job loss.

- Federal taxes on the profit generated if you perceive rental income: You may be subject to these if you’ve used your home as an income property, whether you rented it full-time or only sporadically as a short-term vacation rental. The taxation rules vary based on whether the property you rented can be defined as a business or personal residence, which depends on how often you occupy the property yourself in comparison to how frequently you rent it out. If you use the property as a vacation home for more than 14 days per year or occupy it for over 10% of the days it’s rented, it’s defined as a residence. Otherwise, it qualifies as a business.

Is FSBO Right for Me?

For most people, selling FSBO is not worth it, and 57% of people who sell their homes themselves already knew the buyer.

That said, selling by owner can be a great option in a few specific situations, such as:

- If you know the buyer yourself or have a buyer lined up

- If you have both general real estate knowledge as well as knowledge of the local housing market

- If you have the time and energy to devote to the process and the ability to invest in professional help as needed

Alternatives to Selling Your Home by Yourself

If selling your home yourself isn’t the right fit for you but you don’t want to work with a realtor, you still have options:

- Cash home buyer: If you’re in a difficult life situation with your property, selling for cash may be a good way to get money quickly and walk away. For example, if the home is seriously damaged and needs repairs, you’re facing foreclosure, you’re going through probate or the property has liens or code violations. Selling to a company like Florida Cash Home Buyers is a stress-free process.

- Discount broker: A discount brokerage helps you connect with real estate agents who are willing to accept lower rates, helping you save on associated fees.

- Short sale: A short sale offers a property at an asking price that’s lower than the current mortgage. It’s usually only used in situations of financial distress or potential foreclosure.

- Auction: Auctions are often a good idea in a competitive market because they can help you sell quickly and emotions may cause people to spend more. In a slow market, selling quickly through an auction can help you avoid the property losing value over time.

- Renting the property: It may make financial sense to rent the property, rather than sell, if you can make a profit, such as if rentals are in high demand locally.

Sell Your Home FAST for CASH

Selling your home doesn’t have to be stressful. If you’re feeling overwhelmed, let Florida Cash Home Buyers take some of the burden off of your shoulders. With just five to ten minutes of your time, we can give you an estimate, followed by a no-obligation cash offer on your Florida home. It’s that simple. Contact us for a free cash offer today!

Most Visited Pages

Click below to go to the page

How It Works

Ever wondered how this whole “we buy houses cash” process works? Here’s where we share all the details!

Testimonials

Ever wondered how this whole “we buy houses cash” process works? Here’s where we share all the details!