If you’re a homeowner looking to sell a house with a lien — a legal claim on your property for nonpayment — it may be difficult to get potential buyers to bite. However, cash buyers like Florida Cash Home Buyers may be an efficient and effective solution that saves you the hassle of trying to clear the lien or having to deal with a real estate attorney.

While it is possible to sell a home with a lien, you’ll need to find a buyer who agrees to assume it or pay it off. If you can’t do that, you’ll need to clear the lien by paying it off in full before selling your home.

Property liens fall into two categories — voluntary and involuntary.

- Voluntary liens are less concerning because the seller agreed to them — the most common type is a mortgage.

- Involuntary liens, on the other hand, are placed on your property if you haven’t paid creditors — for example, a tax lien or code enforcement lien. Involuntary liens can make selling your personal property more difficult because they often indicate you’re in financial distress or have unresolved or ongoing disputes. However, it is still possible to sell a house with a tax lien on it.

Additionally, fines and interest from liens can add up quickly. For example, code violation fines can be as high as $1,000 per day (or more) and continue until your property is brought up to code. Depending on your city, you may be able to pay off the lien through a lien forgiveness or reduction program, as long as you resolve the issue that caused the violation in the first place.

However, if you don’t have enough money or expertise to clear the lien yourself, we can help. If you’re ready to sell your Florida home but it has a lien, fill out our online form or call us at (954) 519-7040 today to see if we can help.

How to Sell Your Home with a Lien

Selling your home with a lien on it might be tricky, but it’s definitely possible. It essentially boils down to two main options: the traditional route, which could be more difficult and time-consuming since you need a lien release prior to selling (in most cases) or going through a buyer like Florida Cash Home Buyers, who may buy it from you even with a lien on it.

Under Florida law, a lien is an encumbrance against your property’s title, meaning you owe someone and they now have a legal claim for payment against your property. The cash-buyer option allows you to avoid a lot of the steps in the traditional process and may not require you to remove the lien on your home.

But if you want to sell your home with a lien in the traditional way, whether you use a real estate agent or do it yourself, you have to deal with the lien first. These sections explain how to manage liens in your home-selling process.

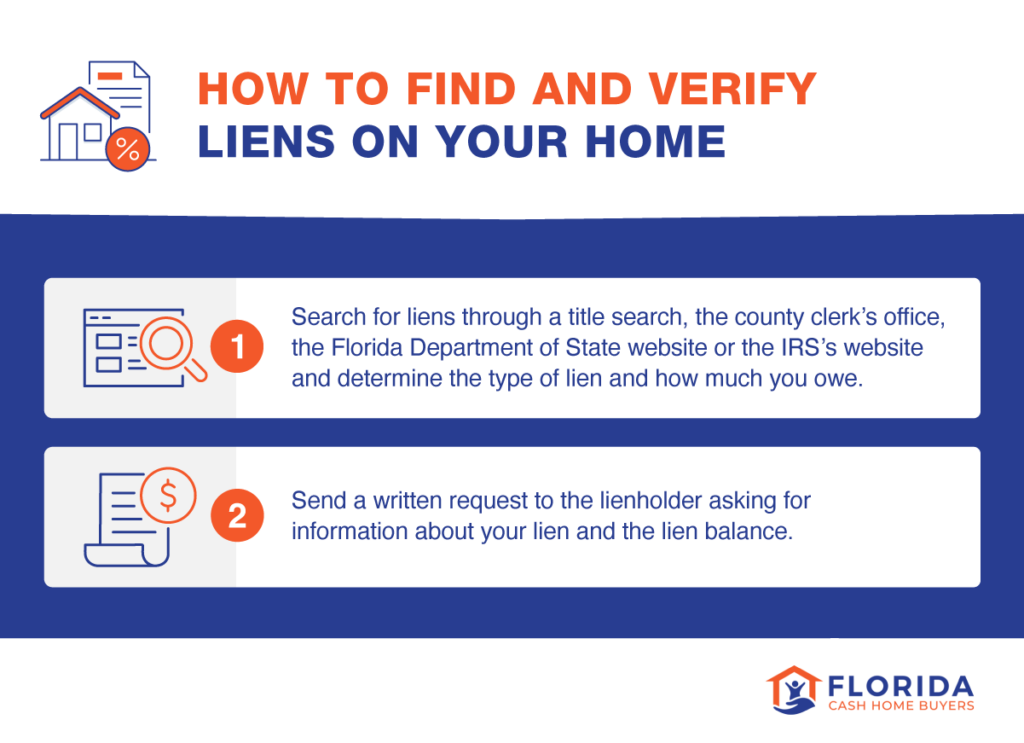

1. Search for a Lien

Before you can even begin the process of selling your home, you need to figure out if your home has a lien or multiple liens and how much you owe. So, first thing’s first: search for liens on your property through the Florida Department of State. You can also conduct a property search on your county’s tax collector site to see if taxes on the property have been paid and review records on the county clerk’s website or visit in person. If you have a federal tax lien, you may need to contact the IRS.

Even if a lien is past the statute of limitations — meaning the lien may not be enforceable — you’ll still need to get it removed from your records. Pay off the lien in full and you should receive documentation of a cleared lien within 60 days.

2. Request the Lien Balance

Next, request the lien balance from the lienholder. This ensures you have accurate information about the lien and how much you owe.

A traditional buyer is unlikely to adopt the lien, so you’ll want to assess if and how you can pay and remove the lien before selling your home. A cash home buyer, on the other hand, may adopt the lien or negotiate a sale even if you have a lien on your home.

3. Determine Next Steps

Now that you know if you have a lien and understand how much you owe, it’s time to determine the next steps to sell your home.

Make sure the lien on your home hasn’t surpassed the statute of limitations, meaning that the lienholder can’t take action to enforce it.

Clear the Lien by Paying Off the Lien in Full

If you can afford to pay off the lien, that’ll make the traditional home-selling process easier.

The lender has 60 days to clear the lien record once you’ve paid. Once you’ve paid the lien amount and the debt is satisfied, the lender must send satisfaction of the debt within 60 days of receiving the payment in full. This may differ depending on legal proceedings involved in involuntary liens.

Apply for Lien Forgiveness or Negotiate a Payment Plan

If you can’t pay the lien in full, contact the lienholder to see if there’s a payment plan or reduction program available. For IRS liens, for example, you can apply online for a payment plan. However, the lien isn’t satisfied until you’ve finished the payment plan, so you won’t be able to sell your house right away.

If you have a municipality lien, like a code enforcement or utility lien, work with your city to get it resolved. Code violation liens can often be reduced if you resolve the issue and apply for an amnesty program. You can check the criteria for receiving a reduction on your city’s website.

Find a Buyer Who Will Clear the Lien

If you can’t pay the lien on your house immediately, you may be able to get an investor to assume the lien and pay it off for you. If you’re considering selling your house with a lien, talk to us to get a clear sense of your options.

4. Check That the Lien Is Cleared From Your Records

Once the lien is paid off, you should receive a release of lien document. The release of lien document should also be filed with the county recorder, which you should verify.

Follow the same steps you did to check for a lien, visiting the Florida Department of State’s website and reviewing records from the county clerk. Even if you’ve paid it off, it may take some time before it’s removed from your public records.

If you had a federal tax lien and it has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release.

5. Sell Your Home

Once the lien is cleared and you have a clear title or you’ve found a buyer willing to assume the lien, you can sell your home.

Understanding the Statute of Limitations on a Lien

The statute of limitations is sort of like a time limit — it’s the amount of time or timeframe in which the lienholder can take action to make you pay the lien you owe. They lose the ability to collect on your lien once the time runs out. However, lienholders may be able to renew the lien to keep it in effect for longer.

You can check the status of your lien by checking the date of the action against you and the amount of time allotted to that specific lien type. If the lien has passed its statute of limitations, you may still need to appeal it to have it removed from your records.

If you have a judgment lien, the Florida Department of State can provide you with information about the lien and guidance about how to remove it.

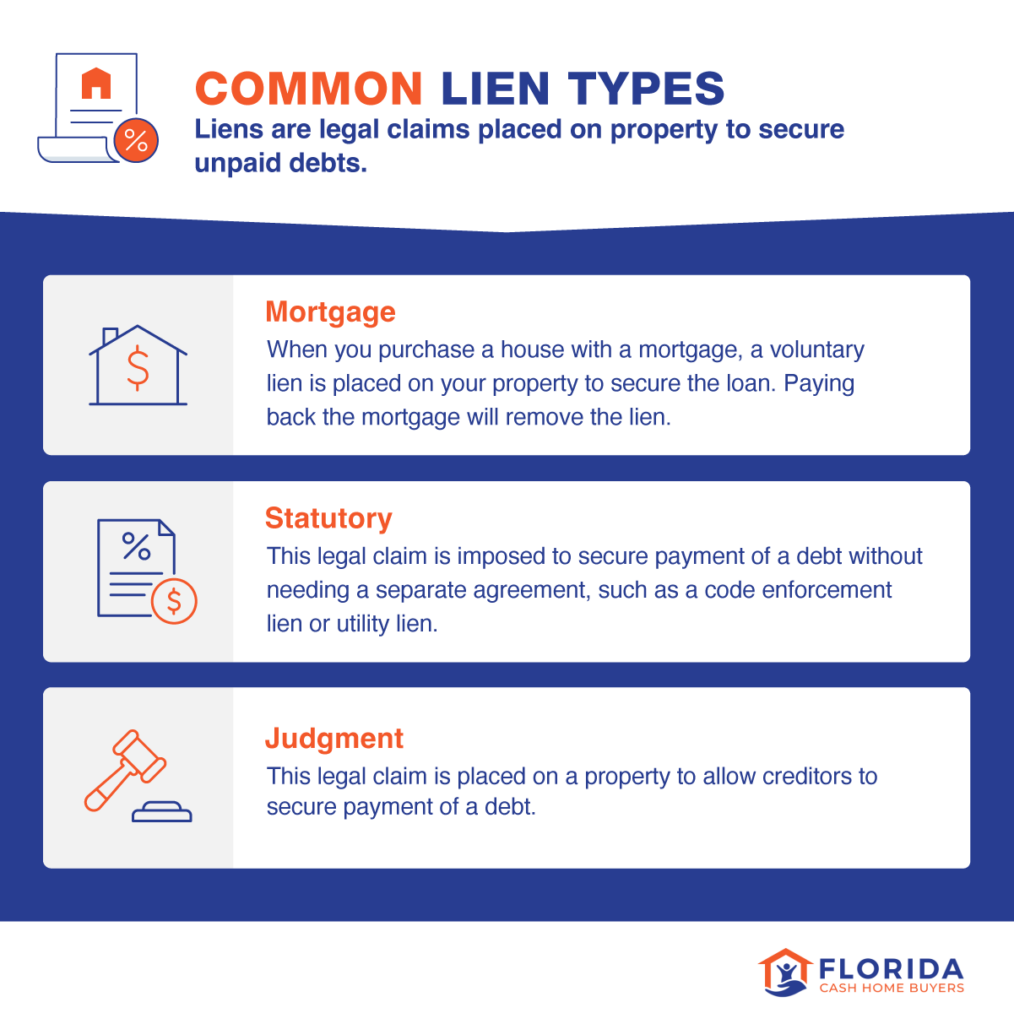

Common Lien Types

A property owner can encounter multiple liens from different sources. We’ve included some common types of liens below.

They can be categorized into voluntary — one that you agree to and create, like a mortgage — or involuntary — one that’s created by law, like a judgment or tax lien.

In general, having a lien on your home limits your ability to sell. You should try to resolve liens if you can regardless of if you’re selling your house the traditional way or with us.

Mortgage Lien

When you purchase a house through a mortgage lender, a voluntary lien is placed on your property as a form of security for that loan. If you stop making mortgage payments, the lender can foreclose on your house to recover the payments.

Mortgages are common liens, and are typically cleared when the seller pays off their loan balance at closing. Liens that the mortgage creates will end 5 years after the mortgage’s final due date or 20 years after the mortgage was recorded if there is no clear due date.

Statutory Lien

A statutory lien is an involuntary lien, which is a legal claim imposed to secure payment of debt without needing a separate agreement. Three common statutory liens include code enforcement liens, utility liens and tax liens.

Code Violation Liens

If you’ve violated a municipal ordinance, such as high weeds, excessive trash on the property or inordinate amounts of noise, the city will notify you to comply. Failure to comply within the specified timeframe could result in accrued fines of up to $1,000 per day for each day (or more) the violation goes unresolved. Once recorded, it becomes a lien against your property.

You can search for code enforcement fines through your city to determine the balance. Once you’ve resolved the violation, contact your city about applying for lien forgiveness, an amnesty program, or paying the full balance.

Utility Liens

Unpaid utility bills can become liens against your property. You can find this lien in your city or public records. Some cities offer the ability for you to apply for a utility lien interest amnesty program. This would give you the option to have any accrued lien interest forgiven if you agree to the program terms, pay outstanding utility costs and pay a lien fee.

Tax Liens

When you don’t pay tax debt, like property taxes, the IRS can put a lien on your property. The statute of limitations of tax liens in Florida are 5 years for general tax liens and 20 years for specific tax liens. An unpaid tax lien can lead to your house being sold at auction unless you pay back the taxes owed within two years.

Mechanic’s Liens

A mechanic’s lien is also known as a construction lien. It happens if the contractor on your home doesn’t pay their subcontractors, material suppliers, or other legally required payments, which can result in those unpaid parties charging payment to your property instead.

Typically, to avoid this situation, ensure that any contractor you hire is insured and properly licensed. The statute of limitations is one year.

HOA Liens

An HOA lien can be placed on your property if you have an HOA and defaulted on your dues. The statute of limitations is five years. If the lien is for a condominium association, the statute of limitations is one year.

Judgment Lien

A judgment lien is a legal claim placed on a property. If a creditor takes legal action against you and you lose the lawsuit, the creditor can place a court-ordered lien on your property to secure the unpaid debt you owe. The statute of limitations is 20 years.

Ready to Sell Your House for Cash?

Real estate is a difficult arena, especially if you know your home isn’t the ideal sell. If you need to sell your home fast, Florida Cash Home Buyers can help, even if there’s a lien on your property.

We’ve purchased properties with a variety of problems, from open code violations and city liens, to open or expired permits and homestead tax penalties. While issues like these may be too much for a regular investor or home buyer, we’re more than equipped to handle them. Plus, you won’t have to deal with a realtor.

Here’s how it works:

- Contact us to discuss your property. We’ll do a comprehensive assessment, ensuring we give you a fair deal and you get the most out of your home sale. After that, we’ll give you our no-obligation offer the same day.

- Receive a written offer. Once you review and sign the written agreement, we start the closing process, which can take about 15 to 30 days.

- Close and receive your funds. Complete the sale with us at either a reputable title company or in your own home. You’ll get your cash sale proceeds via wire or certified check on the same or next business day.

So, if you’re looking for a low-pressure, no-hassle way to sell your home, call us today and see how we can help.