Facing foreclosure may seem like a dead end, but, as scary as it is, you still have options. Whether you’re just behind on payments or already in the foreclosure process, you can take steps to protect your home.

The best approach will depend on factors like your financial standing, property value, and future plans, so be sure to weigh your options carefully.

In this guide, we’ll go over different ways to stop — or avoid — foreclosure in Florida. If you’re looking for a quick and easy out, a cash buyer like us can purchase your home in the foreclosure process. Contact us today to learn more about our process and get your own no-obligation offer.

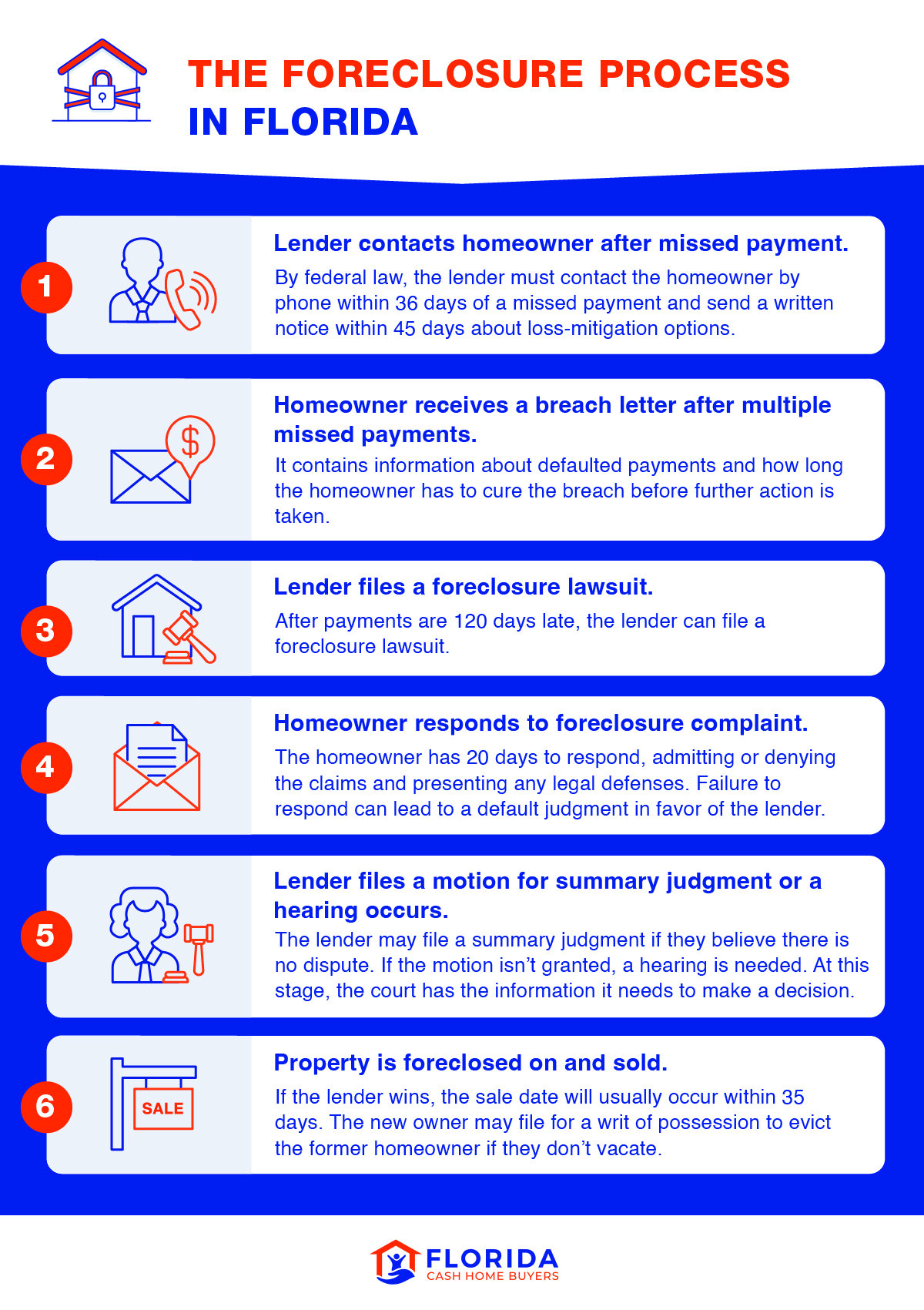

Understanding the Foreclosure Process in Florida

Foreclosure is the legal process a lender uses to repossess a property when the homeowner defaults on their mortgage. Florida is a judicial foreclosure state, meaning foreclosures go through the court system and follow a legal process with certain legal protections outlined in state law.

Federal regulations require mortgage lenders to wait at least 120 days after a borrower defaults on their mortgage to start the foreclosure process. If you know you’re going to miss mortgage payments, contact your lender right away to discuss a plan. Defaulting on your mortgage loan just triggers foreclosure proceedings to start.

Here’s a breakdown of how foreclosures work in Florida:

- Lender contacts homeowner after missed payment: Per federal law (12 C.F.R. § 1024.39), your lender has to contact you by phone no more than 36 days after each missed payment and in writing no more than 45 days after a missed payment to inform you of the missing payments and discuss loss mitigation options.

- Homeowner receives a breach letter (notice of default): Once you’ve missed payments, your lender will send you a breach letter, also known as a notice of default. This letter notifies you of the payments you’ve missed, what you can do to fix the situation, and what will happen if you don’t respond. How long you have to reply depends on your specific situation, so be sure to check with your mortgage company if you’re not sure.

- Lender files foreclosure lawsuit: If your missed payments are delinquent for 120 days or more, your lender can file a foreclosure lawsuit against you. They’ll attempt to deliver the notice directly to you, but, if they can’t, they might resort to service by publication.

- Homeowner responds to the foreclosure complaint within 20 days: You have to respond to the foreclosure complaint within 20 days (Florida Rules of Civil Procedure Rule 1.140) by admitting or denying the claims and presenting any legal defenses. If you don’t respond, your lender can ask the court for a default judgment.

- Lender can file a motion for summary judgment and hearing occurs: Your lender can file for a summary judgment, claiming that no facts or legal arguments you could use can stop the foreclosure. A hearing will be held to determine the case.

- Property is sold: If your lender wins, the court will set a sale date for your home, usually within 35 days (Fla. Stat. § 45.032). But this isn’t necessarily the end — in Florida, you can stop the foreclosure process at any time before the house is sold by paying off the debt you owe. Once it’s sold, the new homeowner might file for a writ of possession to remove you if you don’t vacate the property voluntarily. If you don’t move out within the timeframe of the writ (usually 24), the sheriff can enforce the eviction.

If you think you’re facing wrongful foreclosure due to documentation errors, insufficient notice, or other violations of your rights, it’s crucial to seek legal advice. Hiring a foreclosure defense attorney can clarify your case and ensure that your rights are protected.

You can also file a complaint about wrongful foreclosure practices to:

Can You Sell a House During the Foreclosure Process?

Yes, you can sell your home during the foreclosure process. Under Fla. Stat. § 45.0315, homeowners have a Right of Redemption, which allows you to pay off your mortgage debt any time before the final foreclosure sale.

Selling the property is a common way to settle your debt and avoid foreclosure. If you’re already in the foreclosure process, selling to a cash home buyer can help you sell quickly. However, selling isn’t your only option. We help you weigh the pros and cons of each choice below.

Ways to Stop or Prevent Foreclosure in Florida

If you know you’re going to miss mortgage payments, contact your lender immediately to see what your options are as far as loan modification, repayment plans, or refinancing. They may be willing to help you if you’re going through financial hardship.

If you’ve already missed payments, you still have options, even if the foreclosure process is underway. Remember, Florida homeowners can stop foreclosures at any time before their home is sold by paying off the debt they owe.

To help you find the best path forward, we’ll lay out the options homeowners have at certain stages of foreclosure. Some solutions might be better suited than others depending on your financial situation and other factors.

Early Stage Options

Pre-foreclosure is when a homeowner has missed a payment but the lender hasn’t filed a formal foreclosure lawsuit yet. During this time, you can consider options like loan modification, forbearance, or a repayment plan. While you could pursue these options at any time, your best chance of success is early on, when you aren’t too behind on payments yet.

And if you need more help with negotiations or advocating for yourself, you can also seek out advice from HUD-approved housing counselors.

Loan Modification

A loan modification is an agreement between you and your lender to change the terms of your mortgage. This might involve lowering your interest rate or extending your loan term to make monthly payments more affordable.

Typically, homeowners have to demonstrate their financial hardship and prove they can manage the adjusted payments. This option is best in early-stage foreclosure if you can still afford reduced payments, helping you catch up and avoid further legal consequences.

The pros of loan modification include:

- Long-term solution: A loan modification provides a permanent solution by adjusting the terms of your mortgage, offering stability and better financial planning.

The cons of loan modification include:

- Extended loan term: Modifications can lengthen the loan, increasing the total interest you pay.

- Potential impact on credit: While a modification might not directly affect your credit score, prior missed payments will. The overall impact depends on what and how your lender reports to credit bureaus.

Forbearance

Forbearance allows homeowners to temporarily pause or reduce their mortgage payments due to financial hardship — think losing your job or facing a medical emergency. During forbearance, the lender agrees to postpone foreclosure, so you have some room to breathe. You can financially recover and plan your repayment without the potential to lose your home.

To qualify for forbearance, you typically need to demonstrate genuine financial hardship to your lender. You might need to provide documentation, like your latest mortgage statement, income and expense statements, and supporting documents that validate your financial hardship.

The pros of forbearance include:

- Negotiable terms: Forbearance agreements can be customized based on your financial situation.

- Possibility of extension: If your financial issues persist, your lender might extend the forbearance period.

The cons of forbearance include:

- Debt accumulation: After the forbearance period ends, you have to resume making full payments and make up for the payments you missed, including interest and taxes.

Repayment Plan

A repayment plan is best for homeowners who missed payments due to hardship but are now in a better position, or homeowners at the end of their forbearance period. A payment plan helps you catch up on missed payments by temporarily increasing your monthly payment amount until your debt is paid off, without changing your original loan terms. That’s how it differs from a loan modification, which permanently changes your terms — repayment means you don’t have to refinance.

The pros of a repayment plan include:

- No change to loan terms: The original mortgage terms stay the same so you won’t deal with interest rate changes or loan extensions.

- Customized terms: Repayment plans can be customized to what’s affordable for you. They’re also short-term, typically lasting a few months to a year.

The cons of a repayment plan include:

- Increased monthly payments: Adding your missed payments to your regular monthly payment increases the financial burden.

- Doesn’t reduce ongoing payments: Unlike a loan modification, repayment plans don’t reduce future payments.

Refinancing Your Mortgage

Refinancing means replacing your existing loan with a new one, often with better terms, like a lower interest rate or extended loan term, to reduce your monthly payments and make you less likely to default. While refinancing is possible after missed payments, it depends on factors like your loan type, creditworthiness, income, and equity. To qualify for refinancing, you typically need to have stable income, a good credit score, and enough home equity.

The pros of refinancing your mortgage include:

- Improved mortgage terms: Refinancing can secure better loan terms, like lower interest rates or reduced payments, even if the principal is the same.

- Adjusted payments: In some cases, a short refinance can adjust your mortgage to your home’s current value, making payments easier to manage.

The cons of refinancing your mortgage include:

- Closing costs: Refinancing involves upfront closing costs and fees.

- Qualifying challenges: Poor credit or a lower home value may hinder your ability to get better terms.

- Loan reset: Any progress toward paying off your original mortgage is lost, restarting the repayment process.

Mid-Stage Options

If a foreclosure has been filed but not finalized, you still have options to prevent losing your home. Selling your home, either to a traditional buyer or a cash buyer, can be an effective way to stop foreclosure. But if you want to keep your home, exploring the options we laid out earlier, like loan modification, forbearance, or a repayment plan, might be a better fit.

Selling Your Home to a Traditional Buyer

Selling your home before the foreclosure process is complete helps you avoid losing it to auction. A traditional home sale is a good option if your home is in good condition and you have enough time to navigate the traditional selling process. Selling might also make it possible for you to pay off your mortgage, as well as keep any remaining equity and prevent the potential negative impact on your credit.

The pros of selling to a traditional buyer include:

- Financial relief: Proceeds from the sale can pay off your mortgage and potentially leave you with extra funds.

- Authority over the selling process: You have more control over the timing and terms of your home’s sale, allowing you to negotiate with buyers and set the price.

The cons of selling to a traditional buyer include:

- Costs and fees: You may incur expenses like real estate agent fees, closing costs, and necessary repairs to bring the property to market.

- Time consuming: Selling a home can be time-consuming, from preparing the house to negotiating with buyers.

Selling Your Home to a Cash Buyer

Selling your home to a cash buyer, often as-is, is another great option to avoid foreclosure, especially if you’re in a bind. The process happens much faster than a traditional sale, allowing you to pay off your mortgage quickly. Cash buyers often purchase homes that need repairs, so there are fewer financial hurdles to the sale.

The pros of selling to a cash buyer include:

- Quick sale: The process is faster, helping you avoid foreclosure, get out of debt fast, and spare your credit from negative effects.

- No repairs needed: Cash buyers typically purchase homes as-is, saving you time and money.

- Certainty of sale: Without the need to secure financing, there’s less risk of the deal falling through.

The cons of selling to a cash buyer include:

- Lower sale price: Cash buyers usually offer less than market value for quick closings.

- Less profit: You may end up with little to no profit, especially if you’re in significant debt.

Before working with a cash buyer, research their reputation and ask for proof of funds to ensure they can close the deal.

At Florida Cash Home Buyers, we prioritize transparency in our process and make legitimate cash offers. If you’re curious about how much you’ll lose selling a house as-is, our in-depth article explores different scenarios and the potential pros and cons.

Selling Through a Short Sale

A short sale involves selling your property for less than the mortgage amount with your lender’s approval. The lender might forgive your remaining debt, relieving you of future payments. While you won’t profit, a short sale can resolve the debt and prevent long-term financial damage. To qualify, you typically need to demonstrate financial hardship, like job loss, medical expenses, or divorce.

The pros of a short sale include:

- Debt relief: The lender usually forgives any remaining balance on your mortgage.

- Less impact on credit: Damage to your credit is typically less severe with a short sale than with a foreclosure.

The cons of a short sale include:

- May still owe money to the lender: If the sale doesn’t cover the mortgage, you might still owe money to your lender.

If a short sale sounds like a good option for you, contact us today. We work with a team of short sale negotiators and real estate professionals who specialize in short sales on behalf of Florida homeowners. Even if foreclosure on your home is imminent, we can help you explore alternatives and find a better solution.

Late-Stage Options

Once a foreclosure sale is imminent or a judgment has been made, your options become more limited. However, there are still steps you can take to potentially save your home or minimize damage to your credit.

Deed In Lieu of Foreclosure

A deed in lieu of foreclosure involves voluntarily transferring your property ownership to the lender to satisfy the mortgage and avoid foreclosure. This option minimizes credit damage and may relieve you of any remaining mortgage debt.

To qualify, you have to demonstrate financial hardship and prove that other options, like loan modifications, aren’t possible. Your lender will assess your property’s value and might ask for documentation to verify your financial situation.

The pros of deed in lieu of foreclosure include:

- Debt forgiveness: Lenders may forgive the remaining mortgage debt after you transfer ownership.

The cons of deed in lieu of foreclosure include:

- Lender approval required: Not all lenders accept a Deed in Lieu, so they could still pursue foreclosure.

- May not relieve entire debt: Your lender may not forgive the full outstanding balance.

Filing for Bankruptcy

Bankruptcy should be considered a last resort if you truly can’t afford to pay your debts. It’s important to weigh the potential negative consequences, such as the impact on your credit score, before you proceed.

There are two main types of bankruptcy: Chapter 13 and Chapter 7. Chapter 13 bankruptcy allows you to catch up on missed payments through a repayment plan while keeping your home. This legal protection helps homeowners retain their property while addressing financial challenges. But if the repayment plan fails, foreclosure proceedings are still on the table.

In Chapter 7 bankruptcy, you can eliminate most unsecured debt, providing a fresh start and potentially freeing up income to catch up on missed mortgage payments. You might even be able to keep your home due to the homestead exemption.

Florida’s homestead exemption protects homeowners from losing their primary residence in bankruptcy situations. This exemption, detailed in Fla. Stat. § 196.031, can delay foreclosure, giving homeowners time to handle their financial problems. It also protects home equity from creditors, so you can reorganize your finances without the immediate risk of foreclosure.

The pros of filing for Chapter 13 bankruptcy include:

- Halts foreclosure: Filing for Chapter 13 bankruptcy triggers an automatic stay, stopping foreclosure proceedings.

- Catch up on payments: You can catch up on missed mortgage payments through a structured repayment plan.

- Debt restructuring: Chapter 13 allows you to restructure other debts, potentially reducing your overall financial burden.

The cons of filing for Chapter 13 bankruptcy include:

- Strict repayment plan: Chapter 13 requires strict adherence to your repayment plan, which can last three to five years. Failure to comply may restart the foreclosure process.

The pros of filing for Chapter 7 bankruptcy include:

- Debt relief: Chapter 7 bankruptcy forgives most unsecured debts.

- Quick process: Chapter 7 is generally faster than Chapter 13, taking up to six months.

The cons of filing for Chapter 7 bankruptcy:

- Long impact on credit score: Chapter 7 bankruptcy stays on your credit report for 10 years after you file.

- Limited eligibility: You must pass a “means test” to qualify, which assesses your income and expenses to determine if you’re eligible.

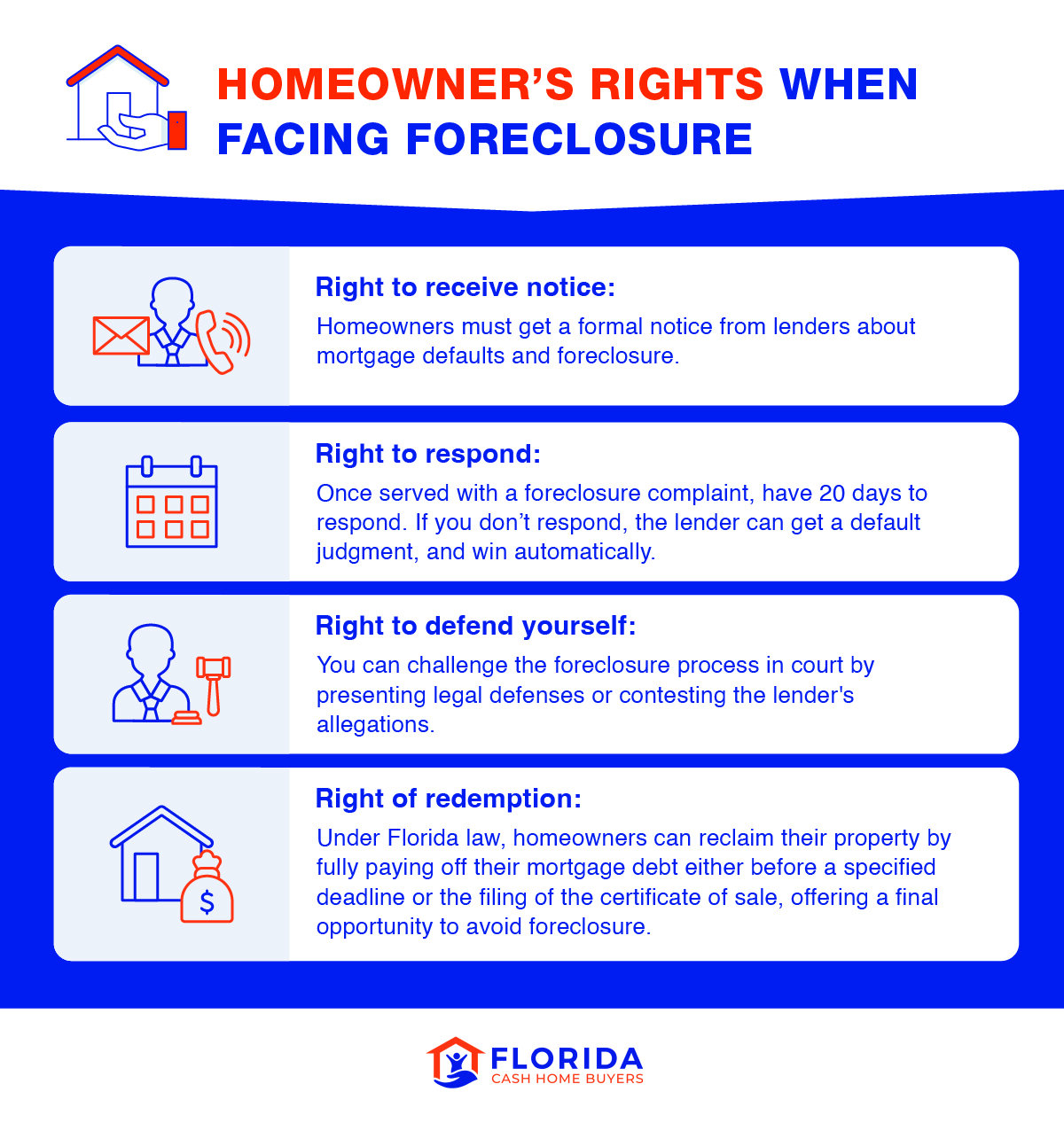

Homeowners’ Legal Rights and Protections Florida

Homeowners in Florida facing foreclosure have important legal rights and protections. These include the right to proper notice, the ability to respond to foreclosure filings, and the opportunity to pursue alternatives like loan modifications or repayment plans. The Florida Foreclosure Mediation Program also assists homeowners in negotiating solutions with lenders.

Understanding these rights empowers homeowners to explore their options, negotiate with lenders, and increase their chances of avoiding foreclosure. Additionally, the Consumer Financial Protection Bureau offers counseling and guidance to help homeowners navigate the foreclosure process.

Foreclosure Assistance and Mediation

Here are some great resources for foreclosure assistance and mediation in Florida:

- The Florida Foreclosure Mediation Program: This helps homeowners and lenders negotiate alternatives to foreclosure through a neutral mediator. The program provides a structured environment for discussing options like loan modifications or repayment plans, often leading to better outcomes and avoiding court.

- Federal mortgage assistance programs: Federal mortgage assistance programs offer support to homeowners struggling to make payments. Programs like HAMP and FHA Mortgage Assistance provide options like loan modifications, forbearance, or temporary relief, making payments more manageable and helping homeowners stay in their homes during times of financial hardship.

Legal Protections for Homeowners

Here are crucial legal protections Florida homeowners are entitled to:

- Right to receive proper notice: Fla Stat. § 702. 015 requires lenders to formally notify homeowners of mortgage default and pending foreclosure actions, allowing them time to respond or resolve the issue.

- Right to 20 days for response: Florida Rules of Civil Procedure, Rule 1.140, typically gives homeowners 20 days to respond to a foreclosure complaint after being served. During this time, they can file a response with the court, contesting the foreclosure, raising defenses, or seeking alternatives.

- Right to challenge the foreclosure process: Rule 1.140(b) allows homeowners to challenge foreclosures in court by raising legal defenses or pointing out lender errors. This could involve proving that the lender failed to follow proper procedures or engaged in unfair lending practices.

- Right of Redemption: Fla. Stat. § 45.0315 allows homeowners to reclaim their property by paying off the full mortgage debt before certain deadlines, providing a final chance to avoid foreclosure.

Warning Signs of a Foreclosure Scam

Homeowners facing foreclosure are vulnerable to scams that promise quick fixes but lead to financial loss. Be wary of these red flags:

- Upfront fees: Scam companies often demand upfront payments.

- Pressure to act quickly: Scammers might pressure you to make hasty decisions, taking advantage of the fact that time is of the essence in foreclosure.

- Guaranteed results: Remember, no one can guarantee specific outcomes in legal or financial matters. If someone does, they’re probably trying to scam you.

- Lack of credentials: Scam companies may lack proper licensing or registration.

- Foreclosure bailout offers: These schemes often involve signing over your deed, leading to property and equity loss.

Before you agree to work with them, always check to make sure a company is registered with the Florida Department of Financial Services or the Better Business Bureau and that they’re licensed to provide foreclosure prevention services or legal aid.

If you decide to work with us at FCHB, you can rest assured you’re in safe hands. We pride ourselves on being transparent about how our process works and how we calculate offers.

Helpful and Trusted Foreclosure Resources

To help guide you to the right places, here are some legitimate foreclosure resources for homeowners in need:

- HUD-approved housing counselors: Free or low-cost assistance to help homeowners avoid foreclosure. They provide expert advice on options like loan modifications or repayment plans and can negotiate with lenders on your behalf.

- Consumer Financial Protection Bureau (CFPB): They provide resources to understand foreclosure rights, help prevent unfair practices, and allow homeowners to file complaints about misconduct, safeguarding against abusive lending or foreclosure processes.

- Florida Department of Financial Services: They offer information on available assistance programs, such as the Florida Hardest Hit Fund. They also help consumers understand their rights during the foreclosure process and oversee regulations to protect against unfair lending practices. Additionally, the department supports financial education to empower homeowners in making informed mortgage decisions.

- Federal Trade Commission (FTC): The FTC enforces regulations against deceptive lending and foreclosure scams. It provides resources to help consumers recognize fraud and file complaints against abusive lenders, ensuring you get fair treatment during the foreclosure process.

- Making Home Affordable (MHA): This federal program provides options for mortgage modification and refinancing at lower rates. Through initiatives like the Home Affordable Modification Program (HAMP), MHA works to reduce monthly payments and stabilize the housing market.

- U.S. Department of Veterans Affairs (VA): If you’re a veteran, you can get support through the VA home loan program, which helps secure better loan terms, such as no down payment and lower interest rates. If a veteran faces financial difficulties, the VA also offers assistance with mortgage relief and counseling to help navigate potential foreclosure situations.

Avoid Foreclosure By Selling to a Cash Buyer

If you’re facing foreclosure and need to sell your home quickly, don’t panic — Florida Cash Home Buyers is here to help. We offer a fast and hassle-free solution, allowing you to close within 15 to 30 days and move on with your life. Contact us today and see how we can simplify selling your home as-is.