You can legally sell a condemned house in Florida, even if it has major structural issues, code violations, infestations or safety hazards — as long as the property’s condition is fully disclosed to the buyer. Florida law does not require a seller-initiated home inspection to complete a sale, though buyers or municipalities may still require one depending on local enforcement rules.

Because condemnation is enforced by local governments, selling a condemned house in Florida usually comes down to two things: whether the buyer is willing to accept the property as-is and assume responsibility for existing violations, and whether local code enforcement allows the transfer to occur without repairs or demolition beforehand.

If your Florida home receives a condemnation notice— often issued as an “Unsafe Structure” notice — it means local authorities have declared the property unsafe or uninhabitable. Once a condemnation notice is issued, homeowners are typically given a list of required repairs, deadlines for compliance and potential fines if the issues are not addressed, which can quickly make repairs financially unrealistic.

Most condemned homes reach this status due to serious safety issues or code violations, such as:

- Structural damage or a failing foundation

- Severe infestations, mold or asbestos

- Fire damage, water or flood damage

- Dangerous electrical or plumbing systems

- Long-term neglect or unfinished renovations

That’s why many homeowners choose to sell rather than repair. Florida Cash Home Buyers allows you to sell your condemned house as-is, avoid costly repairs and inspections, skip realtor commissions and close on your timeline. Most importantly, you get a clear, stress-free path forward during a time when the property’s condition may feel completely out of your control.

Legal Requirements for Selling a Condemned House in Florida

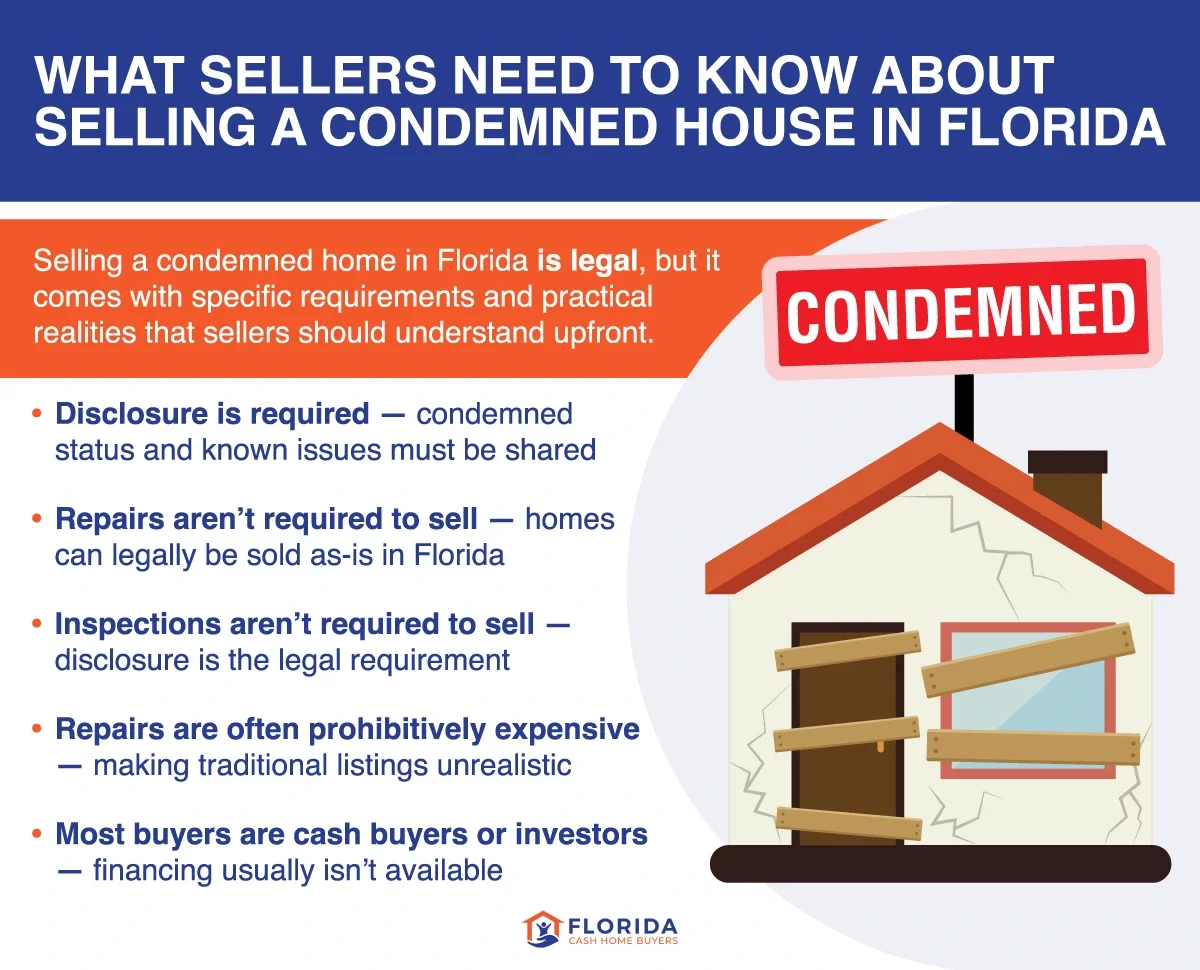

Selling a condemned house in Florida is legal, but it comes with specific requirements that property owners must follow to ensure the transaction is valid and enforceable.

Florida law requires sellers to disclose all known material facts about the property, including:

- The condemned status of the property

- Known structural damage and safety issues

- Any open code violations, liens or fines

Because condemned homes typically aren’t eligible for traditional financing, most buyers will be cash buyers or real estate investors. This limits the buyer pool but does not prevent a legal sale.

Many homeowners also choose to involve a real estate attorney to ensure disclosures are handled correctly and legal issues are resolved at closing. This helps protect both parties and ensures the sale complies with Florida real estate transaction requirements.

How to Sell a Condemned House in Florida (Step-by-Step)

If your house has been condemned, it’s easy to feel stuck or overwhelmed. The good news is that selling a condemned property is still possible. The following steps break down what to do next, helping you understand your options and move forward with clarity.

Step 1: Understand Why the Property Was Condemned

Start by carefully reviewing the condemnation notice issued by local authorities (often labeled in Florida as an “Unsafe Structure” notice). This document explains why the property was declared unsafe and what must happen next.

At a minimum, you should identify:

- The specific code violations or safety issues (structural damage, electrical hazards, mold, infestations and so on)

- Whether repairs are mandatory or optional to lift the condemned status

- Deadlines, fines or enforcement actions, including the risk of additional penalties or demolition

In many cases, the condemnation notice provides only a high-level summary. To fully understand the scope of the problem, homeowners often choose to get a professional home inspection.

An inspection can help clarify:

- The true extent of structural damage or safety issues

- Whether problems are isolated or widespread

- A more realistic picture of what repairs would actually be required

This step is not about committing to repairs — it’s about gaining clarity. Understanding why the home was condemned and how serious the issues are allows you to make an informed decision about whether repairing the property is financially realistic or whether selling the home as-is is the smarter option.

Step 2: Choose a Selling Strategy That Matches Your Situation

When a home is condemned in Florida, traditional selling methods become extremely limited. Most buyers can’t use lenders, and many won’t take on safety or legal risks. As a result, homeowners typically end up choosing between three realistic selling paths:

| Selling Option | Best For | What to Consider | Costs | Speed |

|---|---|---|---|---|

| Sell as-is to a cash home buyer | Sellers who want a fast, certain, hassle-free sale | Direct sale — no repairs, no fees | None | Quick |

| Auction the property | Sellers seeking speed but not the fastest option | Quicker than selling with an agent, but no control over outcome |

Moderate (auction fees) |

Moderate to quick |

| Sell as-is with a real estate agent | Sellers willing to wait for investor offers | Limited buyer pool and long listing times |

High (agent commissions) |

Slow to moderate |

Each option comes with different timelines, costs and levels of certainty. In real-world situations:

- Sell as-is to a cash home buyer: The fastest and most predictable option, you simply request a cash offer based on the property’s current condition, with no repairs, inspections or financing delays.

- Auction the property: Often faster than selling as-is with an agent (but includes fees and limited control over the final price), you’ll submit the property to an auction platform to move forward, and then you accept the highest bid.

- Sell as-is with a real estate agent: This option limits the buyer pool to cash investors and can involve longer listing times and negotiations, and it involves listing the property and waiting for investor offers.

And while it’s technically possible to repair a condemned home and list it traditionally, this path is rarely realistic. Repairing a condemned property often requires tens of thousands of dollars upfront, multiple inspections and no guarantee the home will pass reinspection or sell quickly. For most homeowners, this option adds risk rather than reducing it.

For homeowners facing fines, liens, foreclosure risk or mounting stress, the most reliable path is usually a direct sale to a cash home buyer. Florida Cash Home Buyers specializes in condemned homes and serious code violations. We buy houses as-is, handle complex issues at closing and provide a guaranteed cash offer without inspections, lender delays or agent fees. For many sellers, this isn’t just the fastest option — it’s the only option that provides certainty and peace of mind.

Step 3: Close the Sale

At closing, ownership of the property officially transfers to the buyer. If you’re working with a cash home buyer, this is when the issues tied to the condemned house are resolved, including:

- Liens and unpaid fines

- Open code violations

- Title or legal issues

Once the transaction is complete, responsibility for the property — and its violations — moves to the cash buyer, allowing you to walk away with funds and peace of mind.

What Happens to Home Value After Condemnation

A condemned house in Florida is not valued like a normal home. After a property is deemed unsafe or uninhabitable — often through an “Unsafe Structure” notice issued by local authorities — its price is based on risk, repair costs and land value, not move-in condition or traditional comps.

Condemned homes typically sell for significantly less than market value because:

- Lenders won’t finance them

- Repairs are mandatory and often extensive

- Safety issues and code violations reduce buyer demand

In many cases, the structure itself contributes little value. Pricing is frequently based on the land, the neighborhood, and whether renovation or redevelopment makes financial sense. Even in strong Florida housing markets like Miami, Tampa and Orlando, condemnation creates a steep discount because potential buyers must account for necessary repairs, permits, inspections and legal risk.

Condemned homes rarely need just one fix. Buyers factor in multiple major repairs at once, such as:

- Structural repairs (foundation, framing, roof): $10,000–$50,000+

- Electrical or plumbing replacement: $5,000–$30,000+

- Mold remediation or asbestos removal: $2,000–$20,000+

- Infestation treatment and repairs: $150–$3,500+

- Permits, inspections and reinspection fees: $150–$1,000+

It’s not uncommon for total repair costs to reach tens or even hundreds of thousands of dollars — and that doesn’t include holding costs like property taxes, insurance, utilities or fines while repairs are underway. Because buyers subtract these costs from what the home could be worth after repairs, the resulting offers are often far lower than traditional market value.

Other factors that influence value include:

- The extent of structural damage

- Estimated repair costs

- Zoning and property type

- Any liens, fines or legal issues tied to the home

How Florida Cash Home Buyers Calculate Offers

At Florida Cash Home Buyers, we believe in transparency. Every cash offer is based on real numbers — not guesswork or pressure tactics. Instead of focusing on what a home used to be worth, we look at what it could realistically sell for after repairs, then subtract the real costs required to get it there.

The calculation works like this:

|

Cash Offer Amount

|

= |

After Repair Value

|

− |

10% Holding & Selling Costs

|

− |

10% Profit

|

− |

Repair Costs

|

Example breakdown

If a condemned home could reasonably sell for $300,000 after repairs, Florida Cash Home Buyers will factor in:

|

$200,000 Cash Offer

|

= |

$300,000 After Repair Value

|

− |

$30,000 (10%) Holding & Selling Costs

|

− |

$30,000 (10%) Profit Margin

|

− |

$40,000 Repair Costs

|

That results in a $200,000 cash offer, allowing the homeowner to sell the property as-is, without spending money on renovations, waiting for a buyer or paying agent commissions.

Why Cash Home Buyers Are Often the Best Option

For homeowners dealing with a condemned house in Florida, cash home buyers offer advantages that traditional selling methods usually can’t.

- Sell the property as-is: No repairs, renovations or code compliance work are required.

- No financing delays: No lenders, appraisals or loan approvals will slow or kill the deal.

- Faster closing timelines: Close in as little as 15 to 30 days (or less) with Florida Cash Home Buyers.

- Built for condemned properties: Work with professionals experienced with code violations, condemnation notices and safety issues.

- Liens and fines handled at closing: Issues are often resolved during the home sale, not before.

- No agent fees or commissions: You keep more of the proceeds.

- Clear, predictable outcome: Receive firm cash offers with defined timelines and fewer surprises.

Florida Cash Home Buyers specializes in condemned and distressed properties across Florida. Our local team understands city and county regulations, code enforcement issues and complex title situations that often come with condemned homes. Sellers receive transparent, data-backed cash offers, flexible closing timelines and a straightforward process designed to remove uncertainty — allowing homeowners to sell quickly, legally and with peace of mind.

Sell Your Condemned Home and Regain Peace of Mind

Dealing with a condemned house in Florida can feel overwhelming, especially when repairs are costly, deadlines are looming and traditional selling options don’t seem realistic. This is especially true when the property has been flagged through an Unsafe Structure notice or similar enforcement action. The good news is that you still have options — and you don’t have to navigate them alone.

Whether your property is facing serious structural issues, code violations, liens or safety concerns, selling a condemned home is possible. The key is choosing a path that aligns with your financial situation, timeline and need for certainty. For many homeowners, selling as-is to a cash home buyer offers the simplest and most predictable solution.

If you’re looking for a fast, legal and hassle-free way out, Florida Cash Home Buyers can help. We purchase condemned homes in any condition, handle complex issues at closing and provide fair cash offers with no repairs, no fees and no pressure.